Payday Loans vs Personal Loans – Explore the Difference

Most of the consumers get confused between payday loans and personal loans as they may sound alike, but they are very different. According to the Consumer Financial Protection Bureau, a payday loan is a short term loans which operates for a very short time period and is generally due on borrower’s next payday. However, payday loans are usually available for longer time period that is two to five years. If you are considering to apply for any of them, be sure to understand the difference between both of them.

What are Payday Loans ?

A payday loan is a short-term, high-cost loan that offers instant cash to the consumers which they can return back to the lender on receiving their next paycheck. They typically offer small amounts up to $1500, that’s why they are not adequate to handle major expenses.

During the application process of these loans, the lenders ask about employment status and incomes resources of the borrower. The borrower is also required to submit a post-dated check to cover the amount of the loan, plus a finance fee, it is accessed by the lender to meet the repayment requirement once the salary is transected into borrower’s account. A payday lender never check applicant’s credit score with major credit bureaus that is why they are also known as no credit check payday loans.

Without any doubt, a short term loan sounds to be the most convenient way to arrange instant funds for those who lack with money to meet unexpected expenses but it is the costliest one because of the high fees and finance charges associated with them. They also come with the risk of falling into a long cycle of debt for consumers.

If the borrower does not pay back the loan amount plus all other charges on payday date, then he has to pay additional fees and finance charges. According to the CFPB, the finance charge may range from $10 to $30 for every $100 borrowed. A typical two-week payday advance cash loan with a $15 per $100 fee acquires an annual percentage rate (APR) of almost 400% as per the law.

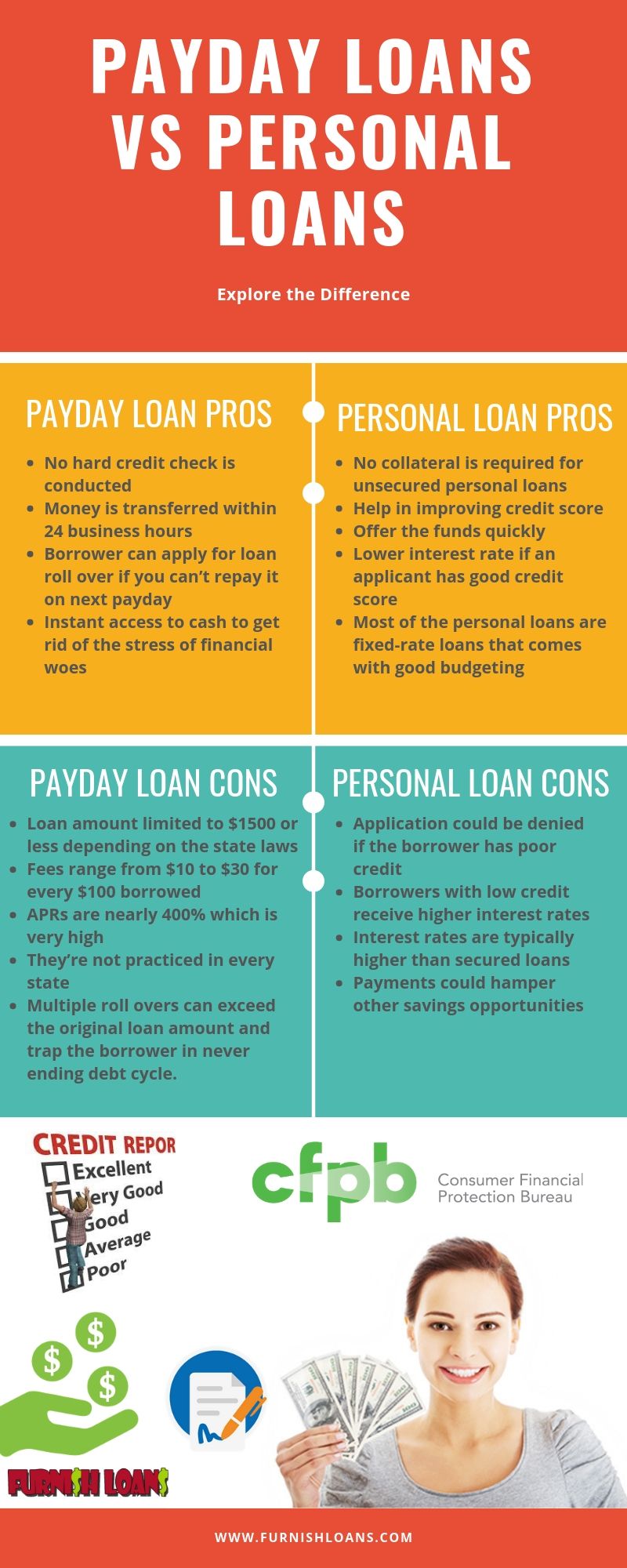

Payday Loan Pros

- No hard credit check is conducted

- Money is transferred within 24 business hours

- Borrower can apply for loan roll over if you can’t repay it on next payday

- Instant access to cash to get rid of the stress of financial woes

Payday Loan Cons

- Loan amount limited to $1500 or less depending on the state laws

- Fees range from $10 to $30 for every $100 borrowed

- APRs are nearly 400% which is very high

- They’re not practiced in every state

- Multiple roll overs can exceed the original loan amount and trap the borrower in never ending debt cycle.

What are Personal Loans ?

A short-term personal loan has a fixed interest rate and fixed repayment period. Unlike regular short term loans, lenders perform hard credit check with three major credit bureaus when a personal loan application is received, and the this inquiry comes with a repercussion as it can lower credit score a little bit each time. If the borrower apply for unsecured loan and it is not backed up by any collateral like a home equity line of credit, then he is charged with high interest rate by the lender so that the lenders can protect themselves against borrowers if the payment is not done on time.

Credit union is the best place to apply for a personal loan because they have lenient lending requirements and are more willing to offer a short-term personal loan to help the consumers. The Local banks and credit card companies can also be great sources, especially if the borrower has already been a reliable customer for any of them. It is better to check the credit score before applying. Once you know your credit score, you can look for a lender’s minimum credit requirements to confirm if you can qualify for a loan. Rather than applying for a loan with number of lenders(which can lower down the credit score), it is recommended to apply for loans with one or two lender that you already know. There are many online lenders who offer personal loans to people who do not have perfect credit score, but not all of them are not reliable. The Federal Trade Commission lists red flags to warn all such fraud lenders.

Personal Loan Pros

- No collateral is required for unsecured personal loans

- Help in improving credit score

- Offer the funds quickly

- Lower interest rate if an applicant has good credit score

- Most of the personal loans are fixed-rate loans that comes with good budgeting

Personal Loan Cons

- Application could be denied if the borrower has poor credit

- Borrowers with low credit receive higher interest rates

- Interest rates are typically higher than secured loans

- Payments could hamper other savings opportunities

Weigh the advantages and disadvantages of both the personal loans and payday loans, and decide to apply for any of them according to your circumstances. When you decide which option is best, then apply with a reliable and licensed lender to make sure you get the legal loan deal.