Spotlight on Payday Loans California and Their Legitimacy

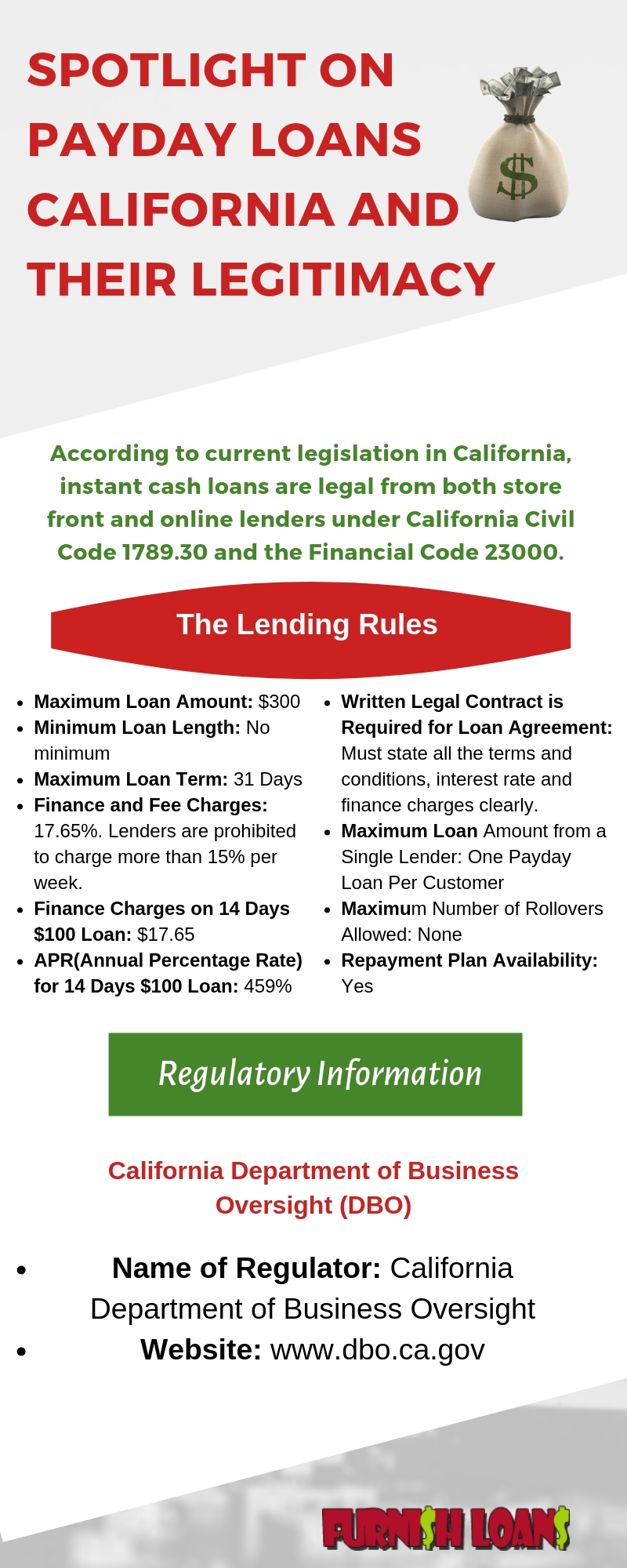

Everyone stays curios to know the legal status of the online short term loans before applying for them in any of the States in US. According to current legislation in California, instant cash loans are legal from both store front and online lenders under California Civil Code 1789.30 and the Financial Code 23000. Both these codes include the relevant regulations for payday loans California to keep the borrowers as well as lenders aware of their respective obligation. All the lenders are asked to have valid States license in which soever state they want to offer this financial aid to the consumers.

There are numerous online lending platforms that act as an intermediate between the borrower and the lenders. Once the borrower fill online application form with few basic personal details on their website, the affiliate website let them connect with the network of 300 payday lenders across the country. They then evaluate the eligibility criteria of applicant and issue the approval accordingly. This whole procedure takes place very quickly and the decision is sent to the borrower on the same day. That’s why these loans are also known as same day approval instant cash loans.

Payday Lending Rules in California

Both the parties involved in the loan process must abide to the following set of rules in this state:

- Maximum Loan Amount: $300

- Minimum Loan Length: No minimum

- Maximum Loan Term: 31 Days

- Finance and Fee Charges: 17.65%. Lenders are prohibited to charge more than 15% per week.

- Finance Charges on 14 Days $100 Loan: $17.65

- APR(Annual Percentage Rate) for 14 Days $100 Loan: 459%

- Written Legal Contract is Required for Loan Agreement: Must state all the terms and conditions, interest rate and finance charges clearly.

- Maximum Loan Amount from a Single Lender: One Payday Loan Per Customer

- Maximum Number of Rollovers Allowed: None

- Repayment Plan Availability: Yes

A borrower must repay one loan before taking out another loan so no rollovers are allowed in California, moreover rollover charges, if asked by the lender, are considered as illegal here. Also, second loan cannot be taken out to repay the first.

The States regulation have also set certain collection restrictions against the lenders to protect the borrowers in case of repayment bouncing. The lender can ask for $15 maximum non-sufficient fund fee for the bounce back of a repayment amount check. A lender is also not permitted to implement any legal proceedings in case of repayment failure.

In case the store front or online lender breaks any of these rules and harasses the consumer, then the consumer can file complaint to California Department of Business Oversight (DBO) to protect themselves.

- Name of Regulator: California Department of Business Oversight

- Website: www.dbo.ca.gov

- Complaints: File a complaint here

Now, when you are familiar with all the rules, choose your lender wisely who obeys these rules. No doubt, payday loans are the quickest and easiest way to boost the cash flow in case of emergency but it is mandatory to understand and consider all the terms, conditions, fees and charges involved in it.